MENUMENU

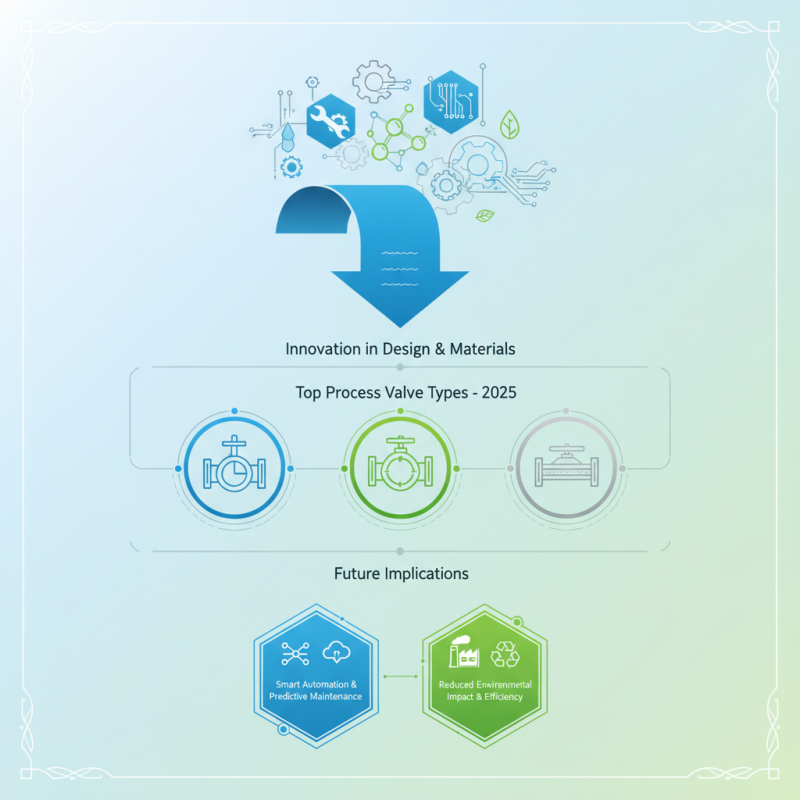

In the evolving landscape of industrial applications, the significance of process valves cannot be overstated. As industries increasingly automate and optimize their operations, ensuring efficient and reliable control over the flows of liquids and gases becomes paramount. According to Dr. Emily Carter, a leading expert in fluid dynamics and process control systems, "The future of process valves will hinge on innovation in design and materials, enabling greater efficiency and sustainability across various sectors."

As we look towards 2025, it is essential to explore the top types of process valves that will define the industry. These valves are critical components in regulating pressure, flow, and temperature, thus directly impacting the overall performance of production systems. The advancements in technologies such as smart automation and predictive maintenance are paving the way for new design philosophies that enhance the functionality of process valves.

This article will delve into the various process valve types poised to revolutionize industrial applications, providing insights into their operational mechanisms, benefits, and the future implications they hold for enhancing efficiency and reducing environmental impact in industrial processes.

In 2025, the landscape of industrial applications will be significantly shaped by advanced process valves designed to optimize efficiency and reliability. One of the leading types of process valves will be the control valve, crucial for regulating flow and pressure in various systems. These valves are equipped with sophisticated technologies that enhance automated operations, ensuring precise adjustments in response to changing conditions. Moreover, the growing emphasis on sustainability in industrial processes will drive the demand for valves that can minimize energy consumption and material waste, reflecting a shift towards more eco-friendly manufacturing practices.

Additionally, the use of ball valves is expected to rise due to their robustness and excellent sealing capabilities, making them ideal for high-pressure and temperature applications. Their simple design allows for quick opening and closing, contributing to operational efficiency. Furthermore, the trend towards smart manufacturing will pave the way for the integration of IoT solutions in valve systems, enabling real-time monitoring and predictive maintenance. This integration will not only enhance the performance and longevity of valves but also lead to significant reductions in downtime and maintenance costs, proving essential in meeting the evolving demands of modern industries.

| Valve Type | Application Area | Key Features | Expected Growth (%) |

|---|---|---|---|

| Ball Valve | Oil & Gas | Quick open/close, minimal pressure drop | 5% |

| Gate Valve | Water Supply | Straight flow path, low resistance | 4% |

| Globe Valve | Chemical Processing | Throttling capability, reliable sealing | 6% |

| Check Valve | Pipelines | Prevents backflow, automatic closure | 3% |

| Butterfly Valve | HVAC Systems | Compact design, easy operation | 7% |

| Solenoid Valve | Automated Systems | Electrically operated, fast response | 8% |

The demand for process valves in industrial applications is experiencing significant growth in 2025, driven by several market trends and technological advancements. Industries are increasingly focusing on automation and efficiency, leading to a greater reliance on high-performance valves that offer precision control over fluids and gases. As manufacturing processes become more intricate, the need for robust and reliable valve solutions that can handle varying pressures and temperatures has become paramount. Companies are investing in advanced materials and smart technologies to develop valves that can provide real-time monitoring and predictive maintenance, thereby enhancing operational reliability and reducing downtime.

Moreover, sustainability is shaping the market trends for process valves. With heightened awareness of environmental issues, there is a growing demand for valves that reduce emissions and improve energy efficiency. Industries are looking for solutions that not only comply with stringent environmental regulations but also contribute to their sustainability goals. This shift is prompting manufacturers to innovate and design eco-friendly valve options that minimize waste and optimize resource usage. As we move further into 2025, the emphasis on sustainability will likely continue to influence the development and adoption of process valve technologies across various sectors, including oil and gas, water treatment, and chemical processing.

In industrial applications, the selection of the right process valve is crucial for operational efficiency and safety. Among the various types of valves available, three primary types are frequently compared:

ball valves,

gate valves, and

globe valves. Each type presents unique characteristics that cater to specific needs in fluid regulation.

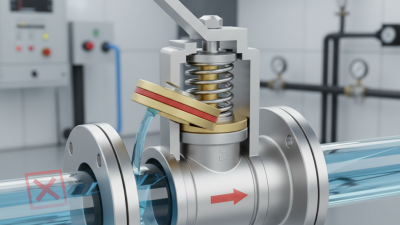

Ball valves are known for their quick operation and minimal pressure drop, making them ideal for applications requiring rapid on-off control. Their design, featuring a spherical disc, allows for a tight seal and excellent flow control, which is particularly beneficial in situations where leakage must be avoided. This characteristic also contributes to their longevity and reliability under high-pressure conditions.

On the other hand, gate valves are commonly used in situations where a straight line of flow and minimal resistance are necessary. They provide a full bore, which allows for unrestricted flow when fully open, making them suitable for applications requiring high volume and low turbulence. However, they are not ideal for throttling purposes, as partially open gate valves can cause excessive wear and potential damage over time.

Lastly, globe valves offer superior throttling capabilities due to their linear flow path. This design allows for precise control over fluid flow, making them an excellent choice for applications requiring fine adjustments. However, they tend to have higher pressure drops compared to ball and gate valves. Understanding these distinctions will aid in making informed decisions about the appropriate valve type for various industrial processes.

The landscape of process valves in industrial applications is rapidly evolving, driven by significant technological innovations aimed at enhancing efficiency. According to a report by MarketsandMarkets, the global market for industrial valves is projected to reach $85.5 billion by 2025, with the growing emphasis on automation and control systems as primary growth factors. These advancements enable improved performance, reliability, and functionality of process valves, thereby increasing overall productivity in manufacturing processes.

One of the key innovations streamlining valve performance in 2025 is the integration of smart technology, including Internet of Things (IoT) capabilities. Smart valves equipped with sensors can monitor flow parameters in real-time, enabling predictive maintenance and reducing downtime. A report from Gartner suggests that by 2025, nearly 50% of industrial devices will have smart technology, leading to enhanced data analytics and operational efficiency. Such innovations not only minimize the risk of equipment failure but also optimize energy consumption, contributing to sustainability goals.

Furthermore, advancements in materials science are paving the way for the development of more durable and corrosion-resistant valve components, which is critical in harsh industrial environments. The adoption of advanced alloys and innovative coatings contributes to longer lifespan and reduced maintenance costs of process valves. The Engineering Toolbox notes that selecting the right materials can enhance a valve's operational performance by up to 30%. As industries continue to prioritize efficiency and sustainability, such technological innovations will be pivotal in shaping the future of process valves in 2025.

In 2025, the selection and utilization of process valves in industrial applications will be significantly influenced by a variety of regulatory standards. The American National Standards Institute (ANSI) and the International Organization for Standardization (ISO) are key organizations setting forth guidelines that ensure the safety and efficiency of industrial processes. Compliance with these regulations is not only important for legal adherence but also for maintaining operational integrity. According to a report by MarketsandMarkets, the global market for process valves is expected to grow from USD 86.3 billion in 2020 to USD 118.8 billion by 2025, reflecting a heightened emphasis on standardized processes.

The impact of regulatory standards extends to the types of materials used in valve construction, design specifications, and operational safety features. For instance, the American Petroleum Institute (API) has stringent requirements for valves used in oil and gas applications, ensuring they withstand extreme conditions while minimizing risks. In a recent study by Research and Markets, 72% of industry professionals indicated that regulatory compliance was a decisive factor in their valve selection process. This growing commitment to meeting established standards is essential for industries aiming to reduce downtime and increase production efficiency, while also aligning with sustainable practices.

This bar chart illustrates the market share of various types of process valves used in industrial applications as of 2025. Ball valves dominate the market, followed by gate and globe valves, while butterfly and check valves hold smaller shares.